The purpose of this document is to summarize the contents of the Information Memorandum (“IM”) prepared by Space Capital Berhad dated 8th August 2020. A copy of the Information Memorandum has been deposited with Securities Commission of Malaysia and Companies Commission of Malaysia. The Brochure is not intended be a prospectus or to form or constitute an offer to sell or a solicitation of an offer to buy any securities. It contains certain excerpts from the IM and should be read in conjunction with the IM. It is recommended for readers to consult with their relevant independent financial advisors prior to making any investment decision.

INTRODUCTION

Space Capital Bhd (“1377629-P”) is a Private Equity Fund that serves as an investment vehicle focusing in assets and companies with strong value proposition and high growth potential areas such as equities and shares, business projects, business acquisitions and fund of funds.

Space Capital is a vehicle for aspiring investors to participate in high-yield technology driven investments in capital markets, businesses and projects.

Space Capital is targeting to create a series of liquidity events which will provide above average returns to its investors while continuing funding the growth and market expansion of promising technology and high growth companies.

This venture is hopeful for a unique and beneficial investment structure for participating investors as it is not only a business partnership venture between Swordfish Solutions Sdn. Bhd. (“General Partner”) and potential investors (if there are interested investors in the Space Capital) but also offers investment return with potential above average capital appreciation.

The focus investment areas as mentioned above are businesses with technology or high potential growth with regional reach. In the long run, investors would benefit from the sizeable increase in shareholders' value. With a commendable and experienced management team in Private Equity investments as well as having extensive local and foreign networks built-up over the years, Swordfish Solutions is able to gain access to the various investment and technology deals.

The potential for creating growth within these sectors is unconditionally vast. Targeted investments of Space Capital are focused in areas that have significant market potential in terms of products and services; technology and global reach. The returns from such investments have been proven to be attractive as the case of asset and technology-based companies listed on local and foreign bourses.

Space Capital is envisaged as a close-end fund with a targeted total capital of RM900 million for the primary purpose to undertake private equity investments into high growth and high-yield assets and companies based on the following points:

- Space Capital is managed By an experienced management team from Swordfish Solutions who have been in the capital markets for 50 years and contributed towards the development of these private assets;

- Swordfish Solutions has formed a formidable joint venture with leading international banks, advisors and institutions that it could leverage in securing good deals and transactions;

- The geographical focus of the Fund is extensive, covering ASEAN region especially Malaysia, Singapore and Indonesia.

- The Fund plans to seek outstanding investment opportunities in areas such as equities and unlisted securities, business projects, business acquisitions and fund of funds.

- The investment period will be 5 years from the point of first disbursement to exit. While IPOs will continue to be an option, trade sales and mergers into existing unlisted/listed entities will also be pursued.

CORPORATE INFORMATION

Swordfish Solutions Sdn. Bhd. (Company No: 1193749-W)

NO: C/A0003/PEMC/2019

Address: Suite 33-01, 33rd Floor, Menara Keck Seng,

No. 203, Jalan Bukit Bintang, 55100 Kuala Lumpur, Malaysia.

Tel: +603 2116 9741 , Fax: +603 2116 5999

Website: www.swordfishsolutions.asia

Email: info@swordfishsolutions.asia

- Datuk Dr. Muniswaran @ Yogeswaran, Mark Eshvaren (“Executive Chairman”)

- Datin Suganthi A/P Ramalingam, (“Executive Director”)

- Tajul Arifin Bin Mohd Tahir

- Rahman Ali Bin Abdul Wahab

- Ariveen Chandran

Address: SAHA & ASSOCIATES No.1-1, Jalan 3/109, Jalan Desa, Desa Business Park, Taman Desa, Off Jalan Klang Lama, 58100 Kuala Lumpur,

Tel: +60379827192

Fax: 0379827193

Email: mail.sahaassociates@gmail.com

Address: A.R. Yahya & Co, Advocates and Solicitors

No. 57-1, Jalan Wangsa Delima 5 (2/27F), Pusat Bandar Wangsa

Maju (KLSC).

Tel: 03-4149 3494 /03-4149 4494

Address: IZAUDDIN, FIRDAUS & MAHENDRAN. Advocates & Solicitors.

No. 8, Tingkat 8, Wisma TCT, No. 516-1, Batu 3, Jalan Sultan

Azlan Shah, 51200 Kuala Lumpur.

MAHENDRAN SHUNMUGAN SUNDARAM DPE (USA)

Tel: 03-40508141

Fax: 03-40511333

Address: RHB Bank Berhad, Damansara Jaya Branch

No. 22 & 24, Jalan SS 22/25, Damansara Utama, 47400 Petaling

Jaya, Selangor.

Tel: 03-9280 8118

PRINCIPAL TERMS OF INVESTMENT

-

General Partner (“GP”)

Swordfish Solutions Sdn. Bhd.

-

Fund Size

RM900 million

-

Offering

36,000 lots of CRPS at a subscription price of RM1.00 each CRPS lot, comprising 25,000 CRPS at RM25,000 per lot

-

Fund Period

Up to 5 years

-

Carried Interest

General Partner will earn Carried Interest of 30% over a hurdle of 12% p.a. return to investors. The remaining 70% is for Limited Partners / Investors.

-

Limited partners

Each investor will be a Limited Partner of the Fund

-

Redemption of CRPS by

Space Capital

Full redemption of Principal Capital Sum with accrued dividend upon 3 to 5 years or the Investors (Limited Partners) will have the option to receive shares of the investee companies as consideration for the redemption of CRPS or cash.

-

Minimum Lock-In Period

3 years

-

GP’s Role

Swordfish Solutions, pursuant to the Information Memorandum, will manage Space Capital based on the following parameters: -

• Evaluate investment proposals, implement investment and divestment decisions, monitor and supervise the performance of the investment portfolios;

• Regularly report on any investment or divestment to the directors and the investors;

• Be responsible for managing the business activities of Space Capital.

-

Issuer Company

Space Capital Bhd.

-

Instrument

Cumulative Redeemable Preference Shares (“CRPS”)

-

Minimum Subscription

1 lot consisting of 25,000 units of CRPS

-

Targeted Return of Investment

(“ROI”)

Targeted ROI of 12% per annum. The returns are payable half yearly, on pro-rata basis, every 30th June and 31st December until maturity of fund or maturity of investment.

-

GP’s Remuneration

Space Capital will pay the GP, an annual management fee of 1% per annum of the total fund size during the investible period of 5 years.

-

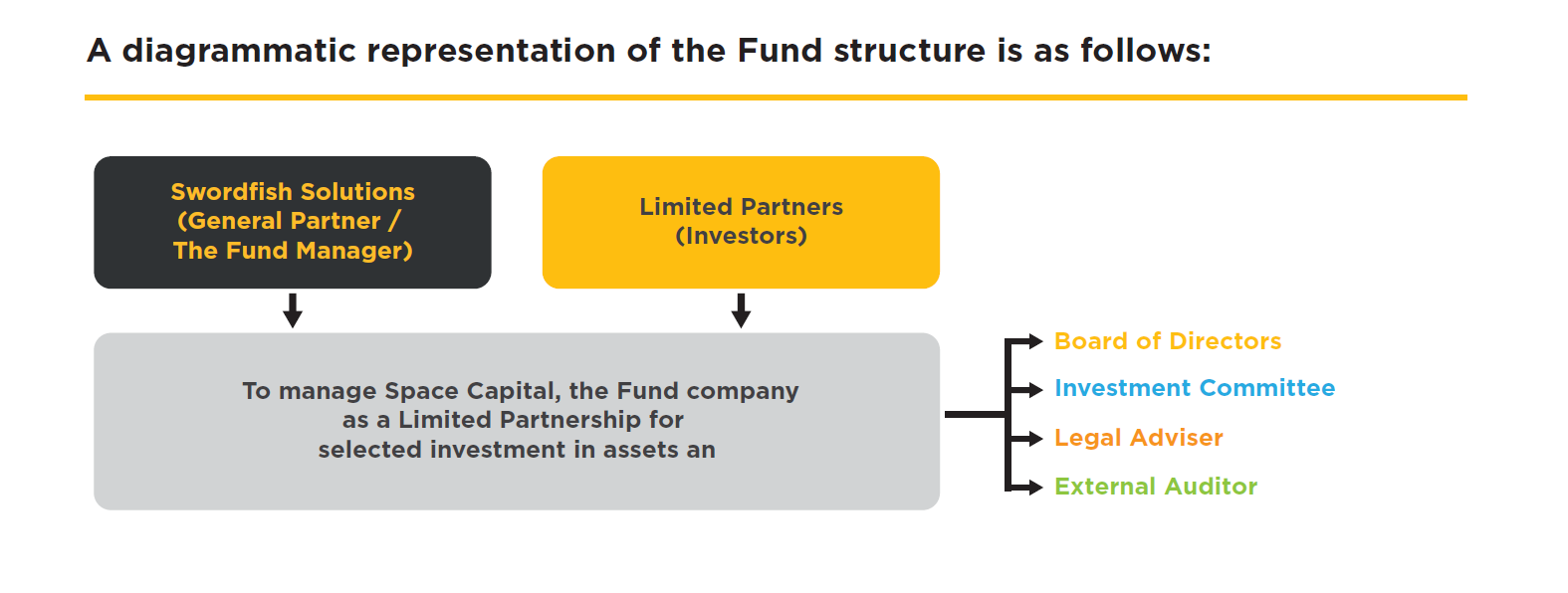

Fund Structure

The Fund is structured as a Limited Partnership and will be managed by the General Partner. The Fund has established an Investment Committee, by which all investment decisions of the Fund must be approved unanimously.

-

Early Redemption by

Investors/Limited Partners

There is no dividend payment for early redemption of less than 3 years investment period as this would disrupt the investment strategy. Therefore, early redemption will be penalised in form of redemption fee of 50% on total investment amount.

-

Geographical focus

ASEAN mainly Malaysia, Singapore and Indonesia

CORPORATE TEAM

Datuk Dr. Mark Eshvaren (Yogeswaran)

Executive Chairman

A serial entrepreneur and astute businessman with a string of investments covering Education, IT, Telecommunications, Financial, Training, and many more. He has built a strong network locally and internationally. His core areas of competency include corporate development, fundraising, training and a flair for closing business deals. Over the years he has embarked on several businesses ranging from marketing to financial literacy. In 2015 he was hooked with financial technology and the global financial scene. Subsequently, he has invested himself in IPO, commodities, bonds, shares and global equity markets. He and his team are in the pursuit of making Swordfish Solutions to be the top organization and a well-diversified Private Equity Management Corporation in Asia.

Rahman Ali Bin Abdul Wahab

Investment Committee, Space Capital Bhd

Rahman, a Malaysian, age 45, Responsible Person & Chief Executive Officer of 5 Pillars since June 2018. From 2012 to 2016, he was an Asian Development Bank (ADB) Consultant for Malaysia based at Economic Planning Unit (EPU) Putrajaya. Responsible to conduct various assignment mainly researches on key industries and to be liaison person for ADB to deal with government's ministries and agencies including EPU, MOF, BNM, SC, TNB etc. From year 2007 to 2012, he was the Chief Executive Officer of SCS Capital Sdn Bhd, a SC registered Venture Capital company. In 5- years he has assisted the company to invest in many transactions covering various industries such as pharmaceutical, biotech, agriculture, IT etc. He has an MBA majoring in Management from International Islamic University (UIAM).

ARIVEEN CHANDRAN

Investment Committee, Space Capital Bhd

Ariveen Chandran brings along more than two decades of experience and expertise in Corporate Consulting, especially in the areas of Business Strategy, Human Capital, and Strategic Operations.

He started his career in the education industry and continues to be very passionate about it. After a short stint in the education industry, he moved on into the Corporate Consulting sector where he worked for organisations such as Deloitte, Right Management and RED Consulting Group. He has vast business knowledge of the local and international markets due to his involvement in multiple business functional projects for many government agencies and corporations. These functional project work would include consulting services for business process improvements, corporate governance, talent management, corporate restructuring, and corporate advisory.

As an active entrepreneur and board member of several organisations, primarily in Education, Technology, and in the e-Commerce industry, he is immensely familiar and proficient in raising capital funds, evaluating investment portfolios, formulating strategic partnerships, and improving company valuations. Additionally, in the last ten years, he has Co-founded and guided several start-ups to their success. He remains committed and continues to support, guide and lead organisations needing corporate advisory assistance on achieving greater heights.

Tajul Arifin Bin Mohd Tahir

Independent Director, Space Capital Bhd

Tajul, a Malaysian, age 52, has 25 years of corporate experience in Malaysia’s capital market, mainly in IPO and secondary placements and other related corporate exercise. He was serving MIDF group, a GLC company from 1991 to 2015 in various capacities.

In 1991, He started his career as a Public Issue Officer in MIDF Consultancy and Corporate Services Sdn Bhd (now known as Tricor Investor & Issuing House Services Sdn Bhd). During his tenure with Tricor Investor & Issuing House Services Sdn Bhd, he participated in enhancing various issuing house processes through the eCommerce initiative jointly organised by SC, Bank Negara Malaysia and Bursa Securities, namely Computerised Balloting System, Electronic Share Application (ESA), eRapids and File Transfer Protocol (FTP) which resulted in a reduced “time to market”. In 2008, he was further promoted to Associate Director where he was responsible for expanding the company’s business network and maintaining relationships with the stakeholders who has been involved in initial public offering exercises in Malaysia to further growing the company’s business.

In March 2018, he co-founded 5 Pillars Ventures Sdn. Bhd, a venture capital management company licensed and registered by the SC, to undertake venture capital activities in Malaysia. In 5 Pillars, he manages the corporate affairs and business development of the company. On 15 October 2018, he was appointed as the Independent Non-Executive Chairman of Mestron Holdings Berhad, a company listed on the Ace Market of Bursa Securities. He also holds directorships in several private limited companies. He graduated with a Bachelor of Science in Business Administration from Saint Louis University, United States in 1989.

TREASURE GROUP INC

Treasure Global Inc was incorporated in the State of Delaware, located at 16192 Coastal Highway, Lewes, Delaware 19958, Country of Sussex. The Delaware Company financial services industry has evolved as one of the world’s most important financial centers, helping to ensure the flow of the global economy and providing professional services second-to-none in many aspects of the industry, such as fund management, the formation of private and commercial trusts and captive insurance.

The Company is set up with the eventual view of being listed on the Nasdaq Stock Exchange in The United States of America. Our Company, which together with our other associates (collectively, “The Group”), have extensive business interests in creating an innovative O2O e-commerce platform with a cross-business profit-sharing business model, focusing on providing a seamless payment solution and capitalizing on big data using Artificial Intelligence technology.

Its proprietary product is an app called ZCITY, which is developed via Gem Reward (GEM) Sdn Bhd.

STRUCTURE OF THE FUND AND MANAGEMENT

The Fund is structured as a Limited Partnership and will be managed by the General Partner. The Fund has established an Investment Committee, by which all investment decisions of the Fund must be approved unanimously. The Fund has also engaged A.R. YAHYA & CO as the legal advisor, who will work with the General Partners and provide legal and governance related services to the Fund.

In a limited partnership, the General Partner is responsible for managing the affairs of the limited partnership, while the Limited Partners are contributors of capital but otherwise ‘silent’ partners. The liability of the limited partners in a limited partnership is limited to the value of their committed capital; however, there are legislative restrictions on limited partners being involved in the management of the limited partnership.

The Fund

Space Capital is a limited company which is incorporated in Kuala Lumpur. The Fund will be established to provide to the potential investors with opportunity to participate in Private Equity Fund investments, focusing in high growth and high potentials assets and companies.

Space Capital will enable the pooling of financial resources to an appropriate amount for effective investments, control and diversification of risk. In addition, the Manager to the fund will provide professional advice, management and administration that should value add to the business operation of the investee companies.

Charter Life

The Memorandum and Articles of Association of Space Capital will provide for a charter life of 5 (five) years. The charter life may, however, be lengthened by special resolution of the investors. At the end of the charter life, Space Capital will be liquidated and its net assets and net profits will be distributed to the respective investors in accordance with its Articles of Association.

Board of Directors

The Board of Directors of Space Capital shall comprise a maximum of 5 members whereby 3 from Swordfish Solutions and 2 Independent Directors, each director shall be entitled to one vote.

It is expressly acknowledged hereto that the BOD of Space Capital shall freely exchange the business knowledge so as to enhance and maximise the decision-making process towards the interest of Space Capital in investing into companies under the management of the Manager.

The Manager

Swordfish Solutions will manage the investments of The Fund for the various investment proposals and implement the subsequent divestments, accordingly.

The Manager will also explore opportunities that arise, co-invest with other investors or Private Equity Funds where it is deemed permissible.

It is through industry experience that Private Equity is an opportunistic activity, which is not subject to rigid planning, however, a set of investment criteria has been established that may serve the Fund the necessary tools to be guided towards its investment process.

The Manager is expected to receive deal flows from various sources, such as personal networking (from other investment banks, private sectors, businessmen) relationships with authorities/regulators/government agencies and deal referrals in general. Other deal sources include other investment managers and financial intermediaries. The Manager is expected to respond to these proposals in a timely and professional manner.

The Manager shall be guided in its decisions by the investment strategies and criteria prescribed in Section 8.0. It shall discharge its best efforts and commit to devote the amount of staff time and resources necessary in order to ensure a stable operation of Space Capital.

Capital Redemption

PEF will have the policy to return some of the surplus capital during its charter life, subject to the retaining of adequate reserves to meet its working capital requirements. Typically, Private Equity companies make their returns from capital gains and since realisations only occur after several years, PEF will strive to pay dividend income derived from investee companies and ensure dividends are shared annually to investors.

Investment Returns

The investment returns to investors will be in two forms, namely annual dividend pay-outs and capital gain. The capital gain will only be realised upon divestment of a particular investment as approved by the Board of Directors of the PEF.

Management Agreement

The General Partner shall manage the overall investment activities of the PEF and will exercise its full discretionary authority to invest the assets of the PEF.

The following are the salient terms of the Management Agreement;

- The General Partner will identify opportunities for investment by the PEF;

- The General Partner will have sole responsibility and full discretionary authority to invest, divest and manage the whole or any part of the PEF’s investments;

- The General Partner will be entrusted with the day to day Management of the PEF’s investments, preparing, monitoring and maintaining the books and records of the PEF, and performing secretarial, administrative duties for the PEF;

- The General Partner will provide financial and other reports to shareholders on a yearly basis, and advise on the appropriate valuation of the investments;

- As consideration for the services to be provided by the General Partner to the PEF, the PEF has agreed to pay the General Partner an annual management fee. The annual management fee is 1% of the total amount of the Fund. After the commitment period, management fees will be charged on the committed amount.

- The Management Agreement shall continue for 5 years provided that if the charter life of the PEF is extended beyond the time frame.

OCTOWILL

INTERNATIONAL MARKETING APPOINTED CONSULTANT

Octowill Inc. is a global legacy management company. It is the next generation distributed and decentralised blockchain Technology for Inheritance planning.

Partnering with Octowill allow Space Capital customers to assign beneficiaries to their assets and investments in a simple 3 steps process. It also allow you, as our customer to assign beneficiaries for contents of your e-wallet with any other service providers located anywhere in the world. In essence, you are writing Digital Will or a Family Trust that can be executed online and the assets and investments can be inherited by your loved ones in the event you pass away.

You simply nominate beneficiaries to your investments with Space Capital and assign them to your loved ones. Octowill automated system will manage your inheritance, establish a digital Will, verify your death, execute a claim and facilitate transfer of your assets to your family via a highly secured blockchain platform.

With Octowill as our partner, contents of your digital wallet can now be safely transferred to your beneficiary upon your demise via a seamless process of technology.

Visit UsAnnouncements

Audited Financial Statements

Take a look at Space Capital's Audited Financial Statements

An in-depth look at our reports and statements for:

Year